I apologize for the lull in posting there, just a lot going on right now. I hope to have a month-end statement by the end of the week, and for now, here's the first in a series of tips to help you save money...and simplify your life.

B

The 11 Best Money Saving Ideas of All Time - Part 1by: Palyn Peterson

At any time in history, no matter what the current state of the economy, no matter what the current trends, no matter what the unemployment rate is or where interest rates lurk, some money-saving ideas stay true.

Some of you may have heard of these ideas before, others may be entirely new to you. But whether you are familiar with these super secrets or not, it will be well worth your while to put them into effect in your own life. The magic they will work on your financial life is guaranteed. I urge you to put them to work - any one of these could change your life! Big changes come from small steps. One plus one does equal two, so if you add one from eleven different places, you will see big results.

This is a four part series giving you advice on saving your hard-earned money in a variety of down-to-earth ways. Nothing here is anything that anyone can't do on a daily basis.

Amazing Money Tip #1: The great scientist Albert Einstein once said, "It takes a genius to see the obvious." What he meant by that is that sometimes the simplest things in life are the most powerful ... but because they are so simple, we tend to ignore them, and not let them work for us.

One of the simplest but most powerful money making ideas is this: keep a daily log of everything you spend. Go to the dollar store and buy a little notebook and carry it with you wherever you go. Write down every penny - every single penny - you spend. It's as simple as that.

If you do this, you will find something magic happening in your financial life in just a few weeks.

There is something incredibly powerful about writing down all your expenditures. It makes the flow of money through your life more real and exact. It shows you simply and clearly just where you are spending your money, on what and why. Once you know that, it becomes much easier to control your spending.

Many people who have taken up this practice have not only learned something about themselves which they never knew before, but they are often astounded.

For example, a person could realized through examining their notebook that they actually spent nearly $2,000 throughout the year on diet soft drinks, snacks and candy bars! Since their job only brings in $25,000 per year, they realized that 8% of their entire income was being frittered away on something entirely frivolous. The person gave up the snacks and drinks, and found they had enough money to go on vacation the following year. If you had the choice between snacks or a much needed vacation, which would you choose?

The point is, it was their daily expense log that helped achieve the insight and clarity they needed to get control of their finances. That's what a simple spending record will do for you - it will give you control over your spending, and thus your financial life. There may be nothing but a 75-cent notebook and a ballpoint pen between your life of financial struggle and financial freedom.

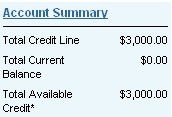

Amazing Money Tip #2: Stop deficit spending! We all know how much trouble Uncle Sam has been creating spending more money than our country takes in. It's called deficit spending. Well, don't fool yourself. The same rules apply to you. Using those evil little plastic cards may be the "American Way," but it's a darn poor way.

Today, the average credit card holder is carrying $8,000 in plastic debt!

Spending yourself into debt with a credit card is unbelievably easy, as many of you already know. The reason is psychological. When you give that clerk a credit card, it's just not the same as handing over a stack of green dollar bills. Would you as readily hand over a fistful of ten dollar bills as flip a credit card across a counter? Probably not.

Credit cards put you in the hole and keep you there. Even for people with good incomes, paying your credit card debt down to zero is amazingly difficult. And make no bones about it, credit card debt will sap your financial strength just as readily as an open vein will deplete your physical body of its very life force. Using a credit card by choice can quickly turn to using it for need. Once you get to that point, you are already in trouble.

There is no secret to freeing yourself from the credit card game. You must take out a pair of scissors today, cut your cards in half, and begin paying them back, slowly but surely. Be sure to always pay more than the minimum amount due, even if it is just $10 more. Once you stop adding to the debt, even small payments will eventually add up. You can get out of debt if you are patient and disciplined. Once your cards are history, you must adopt a strict pay-as- you go policy. Instead of buying now and paying later, save now and buy when you have the full amount.

Once again, this is not rocket science, but stopping credit- oriented consuming is one of the most powerful financial tools available to anyone today. Why not pick up this tool and use it?

Amazing Money Tip #3: Sell your junk. That's right, it's high past time for a major yard sale. Search through your house or apartment for every single item you don't need, and could sell at a flea market or yard sale.

Take an inventory. The truth is, most people are astounded by what they own - and how much money they have tied up in useless stuff. Why let it collect dust in your attic while it could collect interest in a savings account.

You could easily be $500, $1,000 ... even $3,000 richer by the end of the week. As an added bonus, you'd have your place cleaned up, and you will have a fresh feeling of starting over. A garage sale is an excellent way to not only clean out your house, but it often gives a psychological boost that helps people get control of their life and money.

The next of the 11 best money saving ideas of all time will be discussed in part 2. Until then, take note of what you have learned so far and put this information to good use. Read and reread this article; I bet you will notice a difference sooner than you think.

Copyright © by Palyn Peterson

palyn@futureinternetmarketing.com

About The Author

Get the very same internet marketing techniques that many "guru's" are asking you $200 for -- FREE. Discover 24 necessary techniques. You'll also receive a free $gift$. http://FutureInternetMarketing.com/guide.htm

palyn@futureinternetmarketing.com