Direct Line offer a range of Life Insurance policies in the UK

----------------------------------

Ever wondered what it costs to furnish an apartment?

Well, I've been keeping track. The next couple days I will actually make the move into my new place, and once I get settled I'll post the totals of what I spent to move in and we can tally it all up.

On a side note, it's important to me to be able to keep saving money. I set up an automatic withdrawal to send $25 each week to my eMM account. It's not much, but it's something and hopefully I can continue to add to the account and keep it going so that down the road I can have the down payment for a house or similar long term investment.

I'll work on the tally while I move, post that and also a snapshot of the current financial picture sometime soon...

Wednesday, December 29, 2004

Wednesday, December 22, 2004

Moving time

So next week I'll be moving into my new place. I have very little in the way of furniture, but I do have most of the other essentials. So this week I've been looking for a sofa, a chair, and a table and chair set. Discount furniture stores, classified ads, those have been my main source of looking for items. Nothing yet. A friend of mine keeps suggesting IKEA to me. She is very enthusiastic about what they have and their prices and quality. I don't know too much about their stuff, as there are no stores here. Their stuff can be shipped anywhere as apparently you have to put them together. I'm thinking about it. I don't want to go too cheap, but I want value.

I did buy a computer yesterday. The computer I have here at home is a four year old 600MHz eMachines. I was alerted that Staples has a special on Compaq Desktops, that have one that is $249.99 with a $50 rebate. It's a 2800MHz AMD Processor, with a 40GB harddrive, 256 RAM, CDRW drive, USB 2.0, Firewire, On board Ethernet, Sound and card reader, running on XP Home. A good deal, and something I would've needed sometime in the next year. That's the advantage of having some cash available, you can purchase things when you see an outstanding deal.

I did buy a computer yesterday. The computer I have here at home is a four year old 600MHz eMachines. I was alerted that Staples has a special on Compaq Desktops, that have one that is $249.99 with a $50 rebate. It's a 2800MHz AMD Processor, with a 40GB harddrive, 256 RAM, CDRW drive, USB 2.0, Firewire, On board Ethernet, Sound and card reader, running on XP Home. A good deal, and something I would've needed sometime in the next year. That's the advantage of having some cash available, you can purchase things when you see an outstanding deal.

Friday, December 17, 2004

Budgeting Smart

OK...so I signed the lease today.

Now I need to figure a system to best use my money. I get paid weekly,(and weakly)and I've got to figure out the best way to budget the money from week to week so that I have the amount to pay the rent and also that car payment

Does anyone have an easy system for something like this. Breaking down each week's pay and where it goes, how much can be used that week, and how much needs to be saved towards the bigger bills? Ideally, I also need to be able to put something towards savings as well. Is it even worth it to move your money around so that some is in a higher interest account for short periods? As short as a couple weeks?

In the past, I never put too much thought into this, and it cost me dearly. I was paying bank fees all over the place, because my checking account had a $150 "overdraft" protection, but each time you dipped into that, there was a $6.00 fee. I believe I personally paid for the holiday party at the bank one year. I haven't done this in over a year and half, and don't intend to start now, but want to be smart with my budgeting and finances.

Now I need to figure a system to best use my money. I get paid weekly,(and weakly)and I've got to figure out the best way to budget the money from week to week so that I have the amount to pay the rent and also that car payment

Does anyone have an easy system for something like this. Breaking down each week's pay and where it goes, how much can be used that week, and how much needs to be saved towards the bigger bills? Ideally, I also need to be able to put something towards savings as well. Is it even worth it to move your money around so that some is in a higher interest account for short periods? As short as a couple weeks?

In the past, I never put too much thought into this, and it cost me dearly. I was paying bank fees all over the place, because my checking account had a $150 "overdraft" protection, but each time you dipped into that, there was a $6.00 fee. I believe I personally paid for the holiday party at the bank one year. I haven't done this in over a year and half, and don't intend to start now, but want to be smart with my budgeting and finances.

Wednesday, December 15, 2004

Signing on the line...

So on Friday I will be signing the lease for the apartment. I was actually a little worried that my past credit history was going to come to haunt me even here. Apparently it didn't. They did a credit check, and my hard work of the past year and a half seem to have paid dividends in this case. But now I will have to pay $925 each month for a relatively small apartment, instead of using that money for paying debt and savings. I will say however, that I feel good that I have been able to put some away for an emergency fund and get some things started.

My immediate short term goals will be to learn frugally, and put any extra money I have at the end of the month towards my financial future. I am also exploring ways to make some money on the side, without having much overhead or having to work another job outside the house. One of the comments left on my previous post, suggested an eBook...1000 ways to make money. I spent the $19.90 to download it, and it's pretty interesting thus far...good suggestion. Keep them coming.

I'll try to get you the particulars of my purchases needed to move in, and what my budget is going to look like going forward as the details become known to me.

My immediate short term goals will be to learn frugally, and put any extra money I have at the end of the month towards my financial future. I am also exploring ways to make some money on the side, without having much overhead or having to work another job outside the house. One of the comments left on my previous post, suggested an eBook...1000 ways to make money. I spent the $19.90 to download it, and it's pretty interesting thus far...good suggestion. Keep them coming.

I'll try to get you the particulars of my purchases needed to move in, and what my budget is going to look like going forward as the details become known to me.

Monday, December 13, 2004

Moving on...

It sure looks like my savings plans might slow down considerably starting in January unless I can come up with another source of income. For the last year, I've had a living arrangement in which I have not had to pay rent. This will change as I plan to move at the end of the month. The money with which I had been making additional car payments and putting into my eMM account will now be used for rent.

Why rent? Property prices are out of this world in my area. Also, my credit is still shaky, I need another year or two to get back and stabilized. It's been nearly perfect for a year and half, but I need more time to keep building it.

Some of my decisions are being made right now for lifestyle. I want to live in a certain area, near my family friends. It will be a little less than an hour commute to my job, so my fuel and vehicle maintence costs are going to be pretty high. I'd like to make some additional income without leaving my house. I have another web venture which brings me maybe $150 - $200 on a monthly basis, and perhaps another $6000 in two other months. The next one of those months isn't until May, and will likely only be about $1500. So a more consistant monthly income would be welcome.

Why rent? Property prices are out of this world in my area. Also, my credit is still shaky, I need another year or two to get back and stabilized. It's been nearly perfect for a year and half, but I need more time to keep building it.

Some of my decisions are being made right now for lifestyle. I want to live in a certain area, near my family friends. It will be a little less than an hour commute to my job, so my fuel and vehicle maintence costs are going to be pretty high. I'd like to make some additional income without leaving my house. I have another web venture which brings me maybe $150 - $200 on a monthly basis, and perhaps another $6000 in two other months. The next one of those months isn't until May, and will likely only be about $1500. So a more consistant monthly income would be welcome.

Wednesday, December 08, 2004

Whoops...

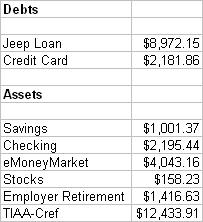

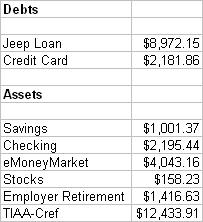

So yeah...it's been awhile, huh? I didn't mean to take the whole month of November off from posting, but it happened. Here's the financial snapshot as of now to try to catch you up to date:

December Financial Snapshot

As you see there was some progress made in the month of November, though not as much as I had hoped. I had wished to pay off the credit card by now. A trip to California, and some work on my car effectively nixed that idea. Now, the money I have in my checking account is likely going to be needed to be used for rent and a security deposit starting January 1st. Going to be tough after that point to keep up the savings rate that I've started. I was supposed to be getting another $2000 from a web project, but that appears to have fallen through for the moment, though it could be revived anyday.

You see a new entry above. Knowing nothing about the stock market really, I decided to take my first baby steps in that area. I opened an account with Sharebuilder.com and put $200.00 into it. I bought $150 worth of Sirius (SIRI) and $50 of the Nasdaq 100. (QQQQ) Normally you would do the opposite, I know that much, putting the majority of your money into an Index type fund. Since it's a small amount, I reversed the roles. This is not serious investing, as I'm just trying to get some experience and work with this arena without getting burned too badly. As you can see, after the fees for purchasing the stocks and a couple days of losses on Sirius, I'm well down in my investment. I don't plan on checking it every single day, but I hope to keep adding to the Nasdaq investment slowly.

I'm not sure yet, but my overall goals may be shifting as well. I'm not sure if the part time by June idea is going to fly, but at the very least I do want to be debt-free by then and have more freedom to do whatever it is I want at that time.

Thanks to those of you who have inquired about the site, and if I'll be keeping it current. I do plan to do better. Keep coming back...

December Financial Snapshot

As you see there was some progress made in the month of November, though not as much as I had hoped. I had wished to pay off the credit card by now. A trip to California, and some work on my car effectively nixed that idea. Now, the money I have in my checking account is likely going to be needed to be used for rent and a security deposit starting January 1st. Going to be tough after that point to keep up the savings rate that I've started. I was supposed to be getting another $2000 from a web project, but that appears to have fallen through for the moment, though it could be revived anyday.

You see a new entry above. Knowing nothing about the stock market really, I decided to take my first baby steps in that area. I opened an account with Sharebuilder.com and put $200.00 into it. I bought $150 worth of Sirius (SIRI) and $50 of the Nasdaq 100. (QQQQ) Normally you would do the opposite, I know that much, putting the majority of your money into an Index type fund. Since it's a small amount, I reversed the roles. This is not serious investing, as I'm just trying to get some experience and work with this arena without getting burned too badly. As you can see, after the fees for purchasing the stocks and a couple days of losses on Sirius, I'm well down in my investment. I don't plan on checking it every single day, but I hope to keep adding to the Nasdaq investment slowly.

I'm not sure yet, but my overall goals may be shifting as well. I'm not sure if the part time by June idea is going to fly, but at the very least I do want to be debt-free by then and have more freedom to do whatever it is I want at that time.

Thanks to those of you who have inquired about the site, and if I'll be keeping it current. I do plan to do better. Keep coming back...

Subscribe to:

Posts (Atom)