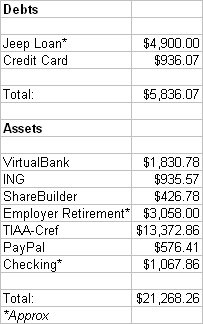

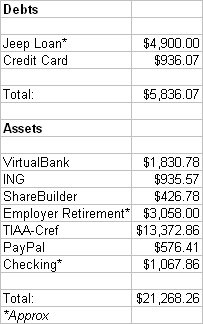

So here is my December 1st, 2005 Financial snapshot. It shows things in pretty good shape since the last one, which I believe was at the end of

August. You can also compare this to

where I was a year ago.

A few points of clarification on the data:

You might wonder why I'm carrying the credit card debt when I have enough in accounts to pay it off. The debt is on a 0% APR card until May of 2006. I plan on paying the balance off before then.

Something to keep in mind with the figures for the month is they included a large cash purchase...namely, Darcy's engagement ring. I'm not going to say how much it was, but lets just say it was in the thousands.

I'm going to be picking up a nice payment sometime in the next month for my first two months of work on the Fox Sports web page. That's likely to be stashed away into some savings to help with wedding expenses.

I've increased my automatic deposit to Sharebuilder to $100 a month. That should help it grow a bit more, as with my previous $50 a month deposit, that included two purchases of $4 each. Now I'm still making two purchases, but a higher % of my money is going to be desposited. (Before: $50 - $8 = $42 Now: $100 - $8 = $92 So now 92% of my deposit is going towards stocks as opposed to only 84% before.) If I keep the same plan, the more I deposit, the higher % of my money is actually going to start working for me.

I need to see if I can afford to double up my weekly withdrawals to ING and VirtualBank as well. Right now $25 a week is automatically going into each account. To go to $50 to each might make things a bit tight for me. I'll ponder this.

So at the moment, I'm automatically placing $300 a month into either MoneyMarket accounts or Investments. For someone who couldn't save at all a few years ago, this is definite progress.