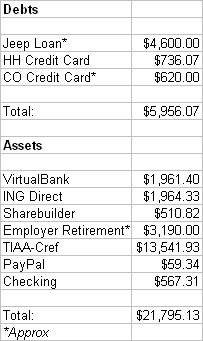

Here's a look at how my accounts shape up here at the tail end of 2005. You'll see a new bit of CC debt with the CO (Capital One) Credit Card. That was for some repairs to my vehicle.

Here's a look at how my accounts shape up here at the tail end of 2005. You'll see a new bit of CC debt with the CO (Capital One) Credit Card. That was for some repairs to my vehicle.2006 looks to be an exciting year, both personally and financially.

- We're getting married in May. Merging of finances has already begun to a certain extent, but will continue throughout the year.

- Much of the savings I have now will likely be eaten up with the wedding and honeymoon.

- I hope to have my car paid off by mid-year. That will be almost 3 1/2 years early.

- We'll be looking into beginning the process of getting some land from my parents and planning and building a house there.

- I hope to see my web ventures continue to grow and make me some side income.

3 comments:

Congrats on ending the year on a positive direction. I will include your data to the following graph shortly.

http://neos-nest-egg.blogspot.com/2006/01/personal-finance-bloggers-net-worth_03.html

Neo

Interesting subject to write a blog about... since you're getting married soon.. might want to check out my blog about wedding ideas 'Til Death Do Ua Part for my own... I'm pinching pennies as well! I also am a wedding photographer so there might be some ideas on my photography blog!

My guy and I are talking marriage and your post will be a great help!

I started my own personal finance blog a few weeks ago. Check it out sometime. Any helpful hints or constructive criticism are much appreciated!

Post a Comment