January

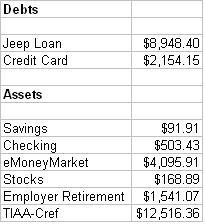

As you see, December was a bit rough. Moving into a new place will do that to you. I'm glad I managed to stay away from using the money stashed away in the eMM account. As mentioned last week, I also set up a recurring deposit of $25 weekly to that account, so I plan to keep that growing.

Ah yes, the move. Here's the rough estimate of what I spent in furnishing the new place. You may have to click on it to enlarge it for viewing.

Move Tally

Some items are exact, others rounded up, as I misplaced a couple of receipts.

What's not counted is the cost for the cable company to hook up cable TV and Internet, as well as the initial food shopping expedition. You'll notice blanks next to some items...I just haven't gotten them yet. So I have no table and chairs in the kitchen, nor a chair and coffee table in the living room.

I also signed up for Vonage to handle my phone service. $25 a month handles all local and long distance...that helps as I've been making a lot of calls across the country the last few months, mostly using my cell phone's free nights and weekends feature. Now I hope to be able to talk on a real phone. As with a couple of things, I have MM at PFBlog.com to thank for not only providing a review of the service, but also a referral that got me a deal.

The next item to get posted here is an exact monthly budget. I've got one worked up for the most part, but to get it here will be progress.

5 comments:

So how was the move in?

-Nev

I hope you don't take this too harshly but as far as finances go, you've got it all wrong. You should never even attempt to start saving and investing until you've gotten rid of all your debts tied to non-appreciating items. For most people, that includes everything except real estate. And by all means, NEVER leave an outstanding credit card balance at the end of any month. When that ever happens, it's a clear sign that you're attempting to live beyond your means. Take the bus instead of driving, don't make trips to California, etc. This is exactly why so much of the country is having debt problems.

Where have you gone? Would love to hear an update!

To say someone should NEVER do something is almost NEVER correct. Each situation, althought we all have a lot in common, is unique. Also, to some extent, managing your money should be in alignment not only with your priorities but your personality, as well.

One financial guru tells you to never pay extra to principle on your mortgae while another says to pay off your mortgage ASAP. Which is correct? Well, it depends on your goals and personality.

I am the poster who suggested paying the minimum on credit card debt but certain conditions apply to that suggestion. One--credit card debt is a symptom of the problem, not the problem, itself. The actual problem is spending in excess of income.

Why do people do that? Sometimes it is a lack of self-discipline but often it is the fact that they are under-etimating their actual expenses. Everything you own that you will want or need to replace when necessary is a bill that is coming due. Examples: tires on your car, the battery in your car, any appliance you own, your car, your computer. Tick, tick, tick...the bill is coming due. Are you budgeting for them?

Most people don't and when the bill comes due they are caught unprepared and will resort, usually, to plastic to pay the bills. Enough of these unbudgeted for expenses too close together and all the sudden you're in debt!

So, do not pay extra to your debts until all these unbudgeted items or accounted for in your budget. Until you do that you are simply robbing Peter to pay Paul and you will wind up having to break out the plastic and stuck in this cycle until you do.

You need an emergency fund. At least enough to get you through 3- 6 months of unemployment or underemployment. Otherwise you are betting your luck will hold--bad bet! Also, make sure you have enough to cover the out-of-pocket limit on your health insurance. Medical bills are the number one cause of bankruptcy.

The key is to get your spending well below your income and save. Worrying about the Visa bill when you're living paycheck to paycheck is the incorrect focus. Your personal security comes first.

I'll also chime in about whether to put money in Savings while paying down debt. While I agree that in a perfectly logical sense, the "right" thing to do not to save a single penny until all debt is paid off (reasons: saving 18% of interest trumps the 2.8% in savings, or even the 10% in stock market; you can always charge on those credit cards again if an "emergency" comes up, so no need for an emergency fund), yet I found this not to work for me.

Getting out of debt can take years. It is disheartening to work your butt off year after year and have no savings to show for it -- even though the debt is going down (and your "net worth" is going up), you feel like you're never getting ahead. From a psychological perspective, I noticed I had little incentive to increase my workload to increase my income -- after all, it just meant more for MasterCard and not me! In addition, I wasn't learning the most important lesson of all -- what it looks like to live below your means and what the fruits of that look like.

Now that I'm putting 10% of my income to savings as well as continuing to pay 20% to my debts, I've got a whole new attitude. I say "yes" to work far more often (I'm self-employed) and gosh darn it, now that I have a growing savings account, doesn't it now FEEL like I'm getting ahead!

I found a very old book to be good for putting my head in the right space financially. "The Richest Man in Babylon". Written in 1926, it's not the most PC on the planet, but it's short, and for those of us who have a hard time living within our means (for any reason), it can be a fascinating read.

Keep up the good work!

Alex

Post a Comment