Thanks to the kind folks at Simon & Schuster I had a chance to receive and review this neat little book. I polished it off in just a couple hours total time, and found it to contain some solid reminders and tools to help me as I move forward with my financial life.

The book is small, and short, coming in at just about 100 pages and is very easy to read. Richard Paul Evans shares with us the five lessons that a multi-millionaire shared with him when he was just a youth. The millionaire is not named in the book, (Though we're told he owned a professional basketball team)he was someone who spent some time with Evans and other youths in the community, trying to impress upon them the importance of handling money right. The book includes lessons from the bible without getting overly 'preachy' or going into doctrine. It's more about certain principles that can help your viewpoint (e.g. "The love of money")

The five lessons are broken out into chapters, and fleshed out a bit, though always remaining simple and easy to understand. Here are the lessons in outline:

1) Decide to Be Wealthy. ("Wealthy" is defined, and may not be what you think.)

2) Take Responsibility for Your Money.

3) Keep a Portion of Everything You Earn.

4) Win in the Margins.

5) Give Back.

That's it. The lessons have sub-points, of course, for instance, there is a bit called "The Millionaire Mentality" taken from J. Paul Getty's 1965 book How to be Rich. In that book, Getty outlined four mind-sets that characterize the wealth builder. They are:

1) The Millionaire Mentality carefully considers each Expenditure.

2) The Millionaire Mentality believes that freedom and power are better than momentary pleasure.

3) The Millionaire Mentality does not equate spending with happiness.

4) The Millionaire Mentality protects the next egg.

Each of those points get a mini-chapter of their own within Lesson Four ("Win in the Margins")

The book also has a number of fine resources at the end, which include a number of ways to actually "Win in the Margins" including ways to increase your income, and ways to save more, including on insurance, travel, utilities and food. There are also two forms included in the book, a Net Worth Sheet and a Cash Flow Sheet. (12 of each in the book, plus access to more online)

As I said, I polished this book off in a couple of hours, and believe I will be referring back to it in the future. It really simplifies what it takes to manage your money and have enough so that you're not in debt and worried about making it from week to week.

Monday, January 16, 2006

Wednesday, January 04, 2006

Year End Statement

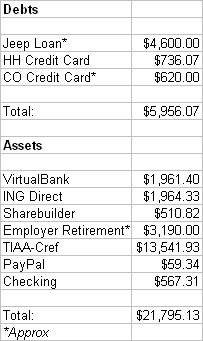

Here's a look at how my accounts shape up here at the tail end of 2005. You'll see a new bit of CC debt with the CO (Capital One) Credit Card. That was for some repairs to my vehicle.

Here's a look at how my accounts shape up here at the tail end of 2005. You'll see a new bit of CC debt with the CO (Capital One) Credit Card. That was for some repairs to my vehicle.2006 looks to be an exciting year, both personally and financially.

- We're getting married in May. Merging of finances has already begun to a certain extent, but will continue throughout the year.

- Much of the savings I have now will likely be eaten up with the wedding and honeymoon.

- I hope to have my car paid off by mid-year. That will be almost 3 1/2 years early.

- We'll be looking into beginning the process of getting some land from my parents and planning and building a house there.

- I hope to see my web ventures continue to grow and make me some side income.

Subscribe to:

Comments (Atom)