Note: Before I begin, please note that I have changed the email address for this blog. I'm finding that people are actually emailing me, and I'm not getting it for a few days because I don't often check the account that I had set up previously.

As I've begun to take my money more seriously and be as responsible as possible with it while still learning and managing to have a life, I've begun to use a number of tools to assist me in this process.

I've used Microsoft Money off and on for years. However since last August, I have been consistent in entering all my transactions into the software. I have the 2005 Deluxe version. I find it helpful for reporting and doing planning scenarios, however I still find myself frustrated with many aspects of it. Some of my accounts simply will not sync with the program. This is extremely annoying, as the whole point of it has been to be able to see all my accounts at a glance. My bank issued a statement saying that they are now compatible with Money and that you can get updates through the program, but I have yet to find them listed in Money's list of banking institutions.

Because of that, I use the on-line banking services of my bank very heavily. They also have bill-pay, so I've started really taking advantage of that feature. I've used their on-line banking since they introduced it, and it's still rather primitive in my opinion. However, it is nice to be able to look and see what transactions have cleared, and to be able send out payments.

The third item I've been using, and this is my most recent addition, is the website Yodlee.com. They have a service called the Oncenter Suite, which allows you to do the "snapshot" thing that I was hoping Money would do for me. You can enter your account information and passwords for your various accounts and get them all on one screen. It also has a billpay service and you can securely store account information for other things you use as well. You can even view multiple email accounts from one window. Seems to work great so far, you can even track rewards programs such as airlines and rental cars. Of course, my bank isn't listed in their very extension collection of financial institutions, so I'm still reliant on my on-line banking application.

I guess it would be nice to have one thing that does all the above. I want a register of my accounts, a snapshot of all of them, reporting features, bill pay, and all the other bells and whistles. Some of it has to do with my bank. Actually it is a Credit Union, so it isn't a national chain that is going to have the high end, feature laden, online banking service. So changing banks would be an idea, though it's not something I'm eager to do. I've been satisfied with this CU since I was barely out of my teens.

Another service that I've heard about, but haven't checked out yet is Billeo - seems somewhat similar to Yodlee, but claims to have more in the way of bill pay and gizmos. Here is a press release on their product.

If you've got financial tools that you rely heavily upon and find indispensable, feel free to leave a comment about them. I'd be interested to check them out.

Saturday, February 26, 2005

Saturday, February 19, 2005

A little background...

OK...so just how badly did I mess up my credit in the past? I can't even get a loan from CAPITAL ONE, even though I got the invitation and have had a great record with them for the last couple years.

It's an ugly story and one I'm still trying to work on. When I was married, I tried to buy my wife's happiness. Well, not exactly, but she had a lot of "issues" stemming back from an ugly childhood. Shopping and spending were some sort of release for her. Her mother was unavailable emotionally and always bought the kids nice things. There's a lot more there obviously, but the human brain is amazing thing, the things that generate certain feelings or sensations don't always seem logical, but usually experts can see right through behavior patterns. In any event, my wife would spend money when she was in a "down cycle" and I, wanting to keep her placated would stretch the budget beyond our means and put us in peril. I would try to make sure I was available emotionally to her, but likely didn't know how to handle those moments. She would refuse counseling so shopping was about the only "therapy" that seemed to life the spirits a bit.

We're no longer married. After a while, the shopping wasn't enough to calm the forces inside her and she started other destructive behavior. Eventually it led to the end of our marriage. She continues her poor use of money to this day, and sadly she was recently diagnosed with terminal cancer at the age of 29. A heartbreaking story all around.

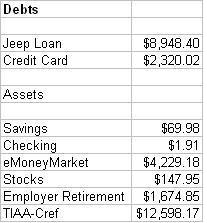

What does this have to do with a financial blog? Well, my weakness in the marriage resulted in late payments, accounts in collection, even a bankruptcy. How could anyone be so stupid and irresponsible with money, you ask? It happens. I take full responsibility for the financial mess I find myself in at this time and I'm trying to make amends. I have only one credit card and a car payment as debt. The interest rates are high. I pay all on time. I pay in advance. I started saving money in the eMM account. It takes time to fix these things. This summer will be two years since the divorce. Emotionally it took me a good year plus to recover. Financially it will likely take a lot longer...

It's an ugly story and one I'm still trying to work on. When I was married, I tried to buy my wife's happiness. Well, not exactly, but she had a lot of "issues" stemming back from an ugly childhood. Shopping and spending were some sort of release for her. Her mother was unavailable emotionally and always bought the kids nice things. There's a lot more there obviously, but the human brain is amazing thing, the things that generate certain feelings or sensations don't always seem logical, but usually experts can see right through behavior patterns. In any event, my wife would spend money when she was in a "down cycle" and I, wanting to keep her placated would stretch the budget beyond our means and put us in peril. I would try to make sure I was available emotionally to her, but likely didn't know how to handle those moments. She would refuse counseling so shopping was about the only "therapy" that seemed to life the spirits a bit.

We're no longer married. After a while, the shopping wasn't enough to calm the forces inside her and she started other destructive behavior. Eventually it led to the end of our marriage. She continues her poor use of money to this day, and sadly she was recently diagnosed with terminal cancer at the age of 29. A heartbreaking story all around.

What does this have to do with a financial blog? Well, my weakness in the marriage resulted in late payments, accounts in collection, even a bankruptcy. How could anyone be so stupid and irresponsible with money, you ask? It happens. I take full responsibility for the financial mess I find myself in at this time and I'm trying to make amends. I have only one credit card and a car payment as debt. The interest rates are high. I pay all on time. I pay in advance. I started saving money in the eMM account. It takes time to fix these things. This summer will be two years since the divorce. Emotionally it took me a good year plus to recover. Financially it will likely take a lot longer...

Saturday, February 05, 2005

Back Again

Feb 2005 Snapshot

I just finished what was probably the busiest month of my life. I apologize for the lack of updates. I'll try to do better.

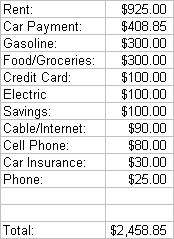

OK, let me try to make a makeshift monthly budget here...this is off the top of my head.

You might notice that the statement atop the masthead of this site has changed. My goals and thinking have changed somewhat as well. Now, I'm just trying to manage what I have in the most sensible way. One of the recent comments on here said I was doing everything wrong. That's entirely possible. However, I believe in balance and trying to have a life. While I have some debt, I also believe it's important to have an "emergency fund" which is why I keep putting money into the eMM. I pay more than the minimums on both my car payment and credit card. The fact that I only have one credit card with a balance is in itself a victory. At this time last year, I had four.

I will try to do better going forward as far as keeping this updating. January 2005 was the busiest month ever.

Subscribe to:

Comments (Atom)