We were doing some quick calculations off the top of our heads yesterday and realized that we spent almost $4000 this year on my parents farm. Here was our fast breakdown:

$1300 Brown Swiss Cow

$800 Truckload of Hay (My Dad had a bad year weather-wise and didn't make as much as usual.)

$600 Milking Shorthorn Cow

$500 Stall Matting

$400 Equipment (Water bowl replacements, collars, etc)

$200 Feed

That's $3800 right off the top of our heads.

Amazing where your money goes...

Thursday, December 28, 2006

Tuesday, December 12, 2006

Checking In Once More

I apologize for the silence on this blog. I didn't mean to phase it out, but there's a lot that has been going on.

We've been spending more and more time at the parent's farm, trying to help them keep up with all that needs to be done there. Our cows are doing fine, the Brown Swiss cow that we purchased in August gave birth to a female calf in October, so our own personal herd grew by 1/3. Way to increase the portfolio!

We're also looking at building a house hopefully next year. We're getting a plot of land from my parents and are exploring our options in that area.

There will be much to do in that area, so I'll try to keep this updated a little more often.

Thanks for checking in!

We've been spending more and more time at the parent's farm, trying to help them keep up with all that needs to be done there. Our cows are doing fine, the Brown Swiss cow that we purchased in August gave birth to a female calf in October, so our own personal herd grew by 1/3. Way to increase the portfolio!

We're also looking at building a house hopefully next year. We're getting a plot of land from my parents and are exploring our options in that area.

There will be much to do in that area, so I'll try to keep this updated a little more often.

Thanks for checking in!

Wednesday, August 30, 2006

Investing in...Cows???

Yup, Cows.

Perhaps you never thought of cows as an investment.

Well, since my parents run a dairy farm, buying cows is an investment like any other. Recently we've bought two cows to bring up to the farm and add to the herd. My parents have mostly holstein cows, with a few jerseys and milking shorthorns mixed in.

One of the cows we bought recently was a Brown Swiss. This is a hardy breed with good milk production (high butterfat) and a pretty docile nature. We paid $1300 for this cow. Seems like a lot for an animal?

Well, we think this cow was worth the money. She's four years old, and is due to calve next month. This means that we could be potentially getting two cows for the price of one.

Adding her milk to the herd will bring more money, though not much initially, because of the low prices that farmers are getting these days (Around $12 for hundred lbs of milk - which means farmers get about $1.50 for every gallon of milk they produce.) However, we're looking at the demand for raw milk, and thinking that we could sell that. The person we bought her from was getting $4.50 for each gallon of raw milk she was selling to people who stop in, and she couldn't keep up with the demand.

The second cow we bought for $600. She's a smaller cow, three years old, needs to put on a little weight, but has good potential. She is a white milking shorthorn.

Both of the cows are also registered, which increases their value. A registered cow has a documented pedigree, which means you can trace their background, and know the strengths and weaknesses of the lineage. It also means that they are a purebred animal.

We'll try and keep you posted on our latest adventures in dairying!

Edit: A couple people have raised the issue of whether raw milk can be legally sold. In the state where I live (NH) you can sell up to 5 gallons a day without a permit, and with a permit you can sell more. Since my father already sells milk commercially, the proper facilities are already in place to make sure that the milk is handled safely.

For the laws in your state, visit http://www.realmilk.com/

Perhaps you never thought of cows as an investment.

Well, since my parents run a dairy farm, buying cows is an investment like any other. Recently we've bought two cows to bring up to the farm and add to the herd. My parents have mostly holstein cows, with a few jerseys and milking shorthorns mixed in.

One of the cows we bought recently was a Brown Swiss. This is a hardy breed with good milk production (high butterfat) and a pretty docile nature. We paid $1300 for this cow. Seems like a lot for an animal?

Well, we think this cow was worth the money. She's four years old, and is due to calve next month. This means that we could be potentially getting two cows for the price of one.

Adding her milk to the herd will bring more money, though not much initially, because of the low prices that farmers are getting these days (Around $12 for hundred lbs of milk - which means farmers get about $1.50 for every gallon of milk they produce.) However, we're looking at the demand for raw milk, and thinking that we could sell that. The person we bought her from was getting $4.50 for each gallon of raw milk she was selling to people who stop in, and she couldn't keep up with the demand.

The second cow we bought for $600. She's a smaller cow, three years old, needs to put on a little weight, but has good potential. She is a white milking shorthorn.

Both of the cows are also registered, which increases their value. A registered cow has a documented pedigree, which means you can trace their background, and know the strengths and weaknesses of the lineage. It also means that they are a purebred animal.

We'll try and keep you posted on our latest adventures in dairying!

Edit: A couple people have raised the issue of whether raw milk can be legally sold. In the state where I live (NH) you can sell up to 5 gallons a day without a permit, and with a permit you can sell more. Since my father already sells milk commercially, the proper facilities are already in place to make sure that the milk is handled safely.

For the laws in your state, visit http://www.realmilk.com/

Tuesday, July 18, 2006

Jeep Paid Off

This week I sent off the final payment on my 2000 Jeep Cherokee. I bought it in December of 2003, and have paid it off in just over two and half years. It was originally a six-year loan.

I was able to do this by just adding extra to my payments each month - being sure to specify that that the extra was to go towards the principal due on the loan. (A Bankrate.com article on this topic has more on the importance of telling the lender your intentions.)

I did make one giant payment somewhere in the middle of the loan, but for the most part, I just added $100 or $200 extra to the payment.

Now we can take the money that was going towards the Jeep and put it towards wedding and honeymoon debt.

I also added another item to my Sharebuilder investments, dipping my feet into the International market by added some iShares MSCI Japan Index (EWJ) to my account. This Exchange Traded Fund includes some of Japan's most well-known companies, such as Toyota, Canon, Honda, and Sony.

Over in the right hand sidebar, I added the new Yahoo! Finance module, which I've set to monitor some of the investments I currently have, while not telling you how much I have in them. (It's very small.)

I was able to do this by just adding extra to my payments each month - being sure to specify that that the extra was to go towards the principal due on the loan. (A Bankrate.com article on this topic has more on the importance of telling the lender your intentions.)

I did make one giant payment somewhere in the middle of the loan, but for the most part, I just added $100 or $200 extra to the payment.

Now we can take the money that was going towards the Jeep and put it towards wedding and honeymoon debt.

I also added another item to my Sharebuilder investments, dipping my feet into the International market by added some iShares MSCI Japan Index (EWJ) to my account. This Exchange Traded Fund includes some of Japan's most well-known companies, such as Toyota, Canon, Honda, and Sony.

Over in the right hand sidebar, I added the new Yahoo! Finance module, which I've set to monitor some of the investments I currently have, while not telling you how much I have in them. (It's very small.)

Monday, July 03, 2006

This and That

I admit, I'm having a hard time coming up with material for the blog here. I'm still very interesting in financial matters and have in fact been working on a few different little things, but nothing that makes me feel worthy of writing a blog post.

We're in the preliminary stages of looking at houses and getting a feel for what and where we can afford. I need to finish up The Automatic Millionaire - Homeowner to make sure I'm pretty well educated for when we head into the process in earnest.

We're attempting to set a household budget and set a goal for eliminating all wedding/honeymoon debt. Right now the initial target is to be in the free and clear by next summer.

I'm trying to put all account, personal and financial information onto a USB jumpdrive, which I will then keep in a fireproof safe or even a safety deposit box to ensure I have that information and documentation in case of an emergency.

We're continuing our savings deposits and investment plans. Currently we're either saving or investing nearly $450 a month.

Trying to decide whether we stick it out in the corporate world for a few more years, or attempt to strike out on our own sometime in the next 5 years. Lots of things to consider there.

We're in the preliminary stages of looking at houses and getting a feel for what and where we can afford. I need to finish up The Automatic Millionaire - Homeowner to make sure I'm pretty well educated for when we head into the process in earnest.

We're attempting to set a household budget and set a goal for eliminating all wedding/honeymoon debt. Right now the initial target is to be in the free and clear by next summer.

I'm trying to put all account, personal and financial information onto a USB jumpdrive, which I will then keep in a fireproof safe or even a safety deposit box to ensure I have that information and documentation in case of an emergency.

We're continuing our savings deposits and investment plans. Currently we're either saving or investing nearly $450 a month.

Trying to decide whether we stick it out in the corporate world for a few more years, or attempt to strike out on our own sometime in the next 5 years. Lots of things to consider there.

Friday, June 09, 2006

Trying to get back into routine

...And we're back...trying to settle into some sort of financial routine.

We have some short and long-term goals, as well as some consolidation to do.

Short Term:

Move some credit card debt to a 0% APR account so we can pay it off quicker.

Pay off the Wedding and Honeymoon expenses.

Pay off my car.

Save enough to get started on a house.

Longer Term:

Build a house, preferable on my parents farm.

Quit the rat race and find a way to be self-sustaining.

Keep the family close.

We have some short and long-term goals, as well as some consolidation to do.

Short Term:

Move some credit card debt to a 0% APR account so we can pay it off quicker.

Pay off the Wedding and Honeymoon expenses.

Pay off my car.

Save enough to get started on a house.

Longer Term:

Build a house, preferable on my parents farm.

Quit the rat race and find a way to be self-sustaining.

Keep the family close.

Monday, May 01, 2006

Leaving on a Jet Plane

Man, where does the time go....

The wedding is this weekend. We'll be away for much of the month of May, but got some great deals (read: complimentary nights) on travel and lodging to make this a once-in-a-lifetime trip to Australia.

Once we get back, it will be right back to simplifying our life and planning for the future.

The wedding is this weekend. We'll be away for much of the month of May, but got some great deals (read: complimentary nights) on travel and lodging to make this a once-in-a-lifetime trip to Australia.

Once we get back, it will be right back to simplifying our life and planning for the future.

Monday, April 03, 2006

A Good Deal, Eh?

Just back from Montreal where Darcy had her Lasik surgery over the weekend. Even with the three night hotel stay and gas for driving about 275 miles each way, we still saved around a $1000 doing it there instead of locally in New England.

We sit now about 5 weeks away from the wedding with a crazy month of April still ahead of us. We've got to consolidate two households plus iron out all the last minute details between now and then.

We sit now about 5 weeks away from the wedding with a crazy month of April still ahead of us. We've got to consolidate two households plus iron out all the last minute details between now and then.

Wednesday, March 08, 2006

Two Month Goals

Financial things I'd like to accomplish in the next two months prior to the wedding:

Pay off my last remaining credit card: $610 (0% APR through May)

Pay off my Car: $3415 remaining. (A tall order)

Continue savings programs ($100 a month to ING, $100 a month to VirtualBank and $100 month to Sharebuilder)

Darcy's getting Lasik surgery at the end of this month. We're actually getting the work done in Montreal, Canada, because even with driving up there (about 4 hours from where we are) and spending 3 nights in a hotel, it comes out almost $1000 cheaper to have it done there instead of done here. The setup is kind of neat, they actually have Eye doctors in our area who do the pre and post op checkups, and then the surgery is done in Montreal. Even saving the $1000, it's going to be a rather expensive weekend. We'll try to keep things light.

Pay off my last remaining credit card: $610 (0% APR through May)

Pay off my Car: $3415 remaining. (A tall order)

Continue savings programs ($100 a month to ING, $100 a month to VirtualBank and $100 month to Sharebuilder)

Darcy's getting Lasik surgery at the end of this month. We're actually getting the work done in Montreal, Canada, because even with driving up there (about 4 hours from where we are) and spending 3 nights in a hotel, it comes out almost $1000 cheaper to have it done there instead of done here. The setup is kind of neat, they actually have Eye doctors in our area who do the pre and post op checkups, and then the surgery is done in Montreal. Even saving the $1000, it's going to be a rather expensive weekend. We'll try to keep things light.

Monday, March 06, 2006

Another Bad Item Knocked Off

A few weeks ago I mentioned that my ex-wife was having problems making car payments on a vehicle that I had co-signed for when we were married. I was having a hard time figuring out what to do since it seemed impossible for her to get another load, and get me off of the current loan.

She called over the weekend and left a message stating that she was able to get a loan and needed me to sign off my rights on the car. She had the dealer fax me a form that I had to sign and return and apparently just like that, I don't have that worry any longer.

Hopefully it really was that simple and that I'll no longer have this bad loan weighing down my credit on a monthly basis.

She called over the weekend and left a message stating that she was able to get a loan and needed me to sign off my rights on the car. She had the dealer fax me a form that I had to sign and return and apparently just like that, I don't have that worry any longer.

Hopefully it really was that simple and that I'll no longer have this bad loan weighing down my credit on a monthly basis.

Monday, February 27, 2006

Got my Capital One credit card paid off this month. (Again) My only current CC debt is my interest free (until May) Household bank account, which has a balance of about $600 right now. My car loan is down to about $3500. Haven't touched the savings accounts for the wedding yet.

Right now I'm currently reading The Automatic Millionaire Homeowner

So far it is very simple, but powerful. I haven't read any of David Bach's other books, but have browse through them at the store. Everyone raves about their simplicity and easy to follow prose. This book is also along those lines.

I'll provide a full review once I've finished it.

Right now I'm currently reading The Automatic Millionaire Homeowner

So far it is very simple, but powerful. I haven't read any of David Bach's other books, but have browse through them at the store. Everyone raves about their simplicity and easy to follow prose. This book is also along those lines.

I'll provide a full review once I've finished it.

Monday, February 13, 2006

Time Flies

I apologize (again) for the lapse in posting. Things like a wedding being held on the opposite coast seem to take a lot of time to arrange.

We're finding the expenses adding up, as we knew they would. We're trying our best to keep the prices low, and to use the credit cards sparingly. However, it's easier said than done. Darcy is keeping a spreadsheet of all wedding related expenses, and it's staggering how quick it adds up.

I've been able to keep up with the savings programs at ING and VirtualBank, $25 goes each week to each account. I'm also doing $100 month to my Sharebuilder account, and spent an extra $100 to pick up some Google shares as they have dropped after the release of Google video. I feel pretty confident that the stock will perform better in the future.

Some of the expenses for the wedding will come this weekend as we fly to the West coast this weekend to get the marriage license, and to confirm our wedding location and interview the photographer. It will be a whirlwind four days.

We're finding the expenses adding up, as we knew they would. We're trying our best to keep the prices low, and to use the credit cards sparingly. However, it's easier said than done. Darcy is keeping a spreadsheet of all wedding related expenses, and it's staggering how quick it adds up.

I've been able to keep up with the savings programs at ING and VirtualBank, $25 goes each week to each account. I'm also doing $100 month to my Sharebuilder account, and spent an extra $100 to pick up some Google shares as they have dropped after the release of Google video. I feel pretty confident that the stock will perform better in the future.

Some of the expenses for the wedding will come this weekend as we fly to the West coast this weekend to get the marriage license, and to confirm our wedding location and interview the photographer. It will be a whirlwind four days.

Monday, January 16, 2006

Review: The 5 Lessons a Millionaire Taught Me

Thanks to the kind folks at Simon & Schuster I had a chance to receive and review this neat little book. I polished it off in just a couple hours total time, and found it to contain some solid reminders and tools to help me as I move forward with my financial life.

The book is small, and short, coming in at just about 100 pages and is very easy to read. Richard Paul Evans shares with us the five lessons that a multi-millionaire shared with him when he was just a youth. The millionaire is not named in the book, (Though we're told he owned a professional basketball team)he was someone who spent some time with Evans and other youths in the community, trying to impress upon them the importance of handling money right. The book includes lessons from the bible without getting overly 'preachy' or going into doctrine. It's more about certain principles that can help your viewpoint (e.g. "The love of money")

The five lessons are broken out into chapters, and fleshed out a bit, though always remaining simple and easy to understand. Here are the lessons in outline:

1) Decide to Be Wealthy. ("Wealthy" is defined, and may not be what you think.)

2) Take Responsibility for Your Money.

3) Keep a Portion of Everything You Earn.

4) Win in the Margins.

5) Give Back.

That's it. The lessons have sub-points, of course, for instance, there is a bit called "The Millionaire Mentality" taken from J. Paul Getty's 1965 book How to be Rich. In that book, Getty outlined four mind-sets that characterize the wealth builder. They are:

1) The Millionaire Mentality carefully considers each Expenditure.

2) The Millionaire Mentality believes that freedom and power are better than momentary pleasure.

3) The Millionaire Mentality does not equate spending with happiness.

4) The Millionaire Mentality protects the next egg.

Each of those points get a mini-chapter of their own within Lesson Four ("Win in the Margins")

The book also has a number of fine resources at the end, which include a number of ways to actually "Win in the Margins" including ways to increase your income, and ways to save more, including on insurance, travel, utilities and food. There are also two forms included in the book, a Net Worth Sheet and a Cash Flow Sheet. (12 of each in the book, plus access to more online)

As I said, I polished this book off in a couple of hours, and believe I will be referring back to it in the future. It really simplifies what it takes to manage your money and have enough so that you're not in debt and worried about making it from week to week.

The book is small, and short, coming in at just about 100 pages and is very easy to read. Richard Paul Evans shares with us the five lessons that a multi-millionaire shared with him when he was just a youth. The millionaire is not named in the book, (Though we're told he owned a professional basketball team)he was someone who spent some time with Evans and other youths in the community, trying to impress upon them the importance of handling money right. The book includes lessons from the bible without getting overly 'preachy' or going into doctrine. It's more about certain principles that can help your viewpoint (e.g. "The love of money")

The five lessons are broken out into chapters, and fleshed out a bit, though always remaining simple and easy to understand. Here are the lessons in outline:

1) Decide to Be Wealthy. ("Wealthy" is defined, and may not be what you think.)

2) Take Responsibility for Your Money.

3) Keep a Portion of Everything You Earn.

4) Win in the Margins.

5) Give Back.

That's it. The lessons have sub-points, of course, for instance, there is a bit called "The Millionaire Mentality" taken from J. Paul Getty's 1965 book How to be Rich. In that book, Getty outlined four mind-sets that characterize the wealth builder. They are:

1) The Millionaire Mentality carefully considers each Expenditure.

2) The Millionaire Mentality believes that freedom and power are better than momentary pleasure.

3) The Millionaire Mentality does not equate spending with happiness.

4) The Millionaire Mentality protects the next egg.

Each of those points get a mini-chapter of their own within Lesson Four ("Win in the Margins")

The book also has a number of fine resources at the end, which include a number of ways to actually "Win in the Margins" including ways to increase your income, and ways to save more, including on insurance, travel, utilities and food. There are also two forms included in the book, a Net Worth Sheet and a Cash Flow Sheet. (12 of each in the book, plus access to more online)

As I said, I polished this book off in a couple of hours, and believe I will be referring back to it in the future. It really simplifies what it takes to manage your money and have enough so that you're not in debt and worried about making it from week to week.

Wednesday, January 04, 2006

Year End Statement

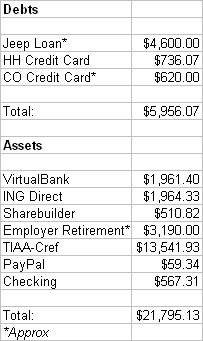

Here's a look at how my accounts shape up here at the tail end of 2005. You'll see a new bit of CC debt with the CO (Capital One) Credit Card. That was for some repairs to my vehicle.

Here's a look at how my accounts shape up here at the tail end of 2005. You'll see a new bit of CC debt with the CO (Capital One) Credit Card. That was for some repairs to my vehicle.2006 looks to be an exciting year, both personally and financially.

- We're getting married in May. Merging of finances has already begun to a certain extent, but will continue throughout the year.

- Much of the savings I have now will likely be eaten up with the wedding and honeymoon.

- I hope to have my car paid off by mid-year. That will be almost 3 1/2 years early.

- We'll be looking into beginning the process of getting some land from my parents and planning and building a house there.

- I hope to see my web ventures continue to grow and make me some side income.

Subscribe to:

Posts (Atom)