Direct Line offer a range of Life Insurance policies in the UK

----------------------------------

Ever wondered what it costs to furnish an apartment?

Well, I've been keeping track. The next couple days I will actually make the move into my new place, and once I get settled I'll post the totals of what I spent to move in and we can tally it all up.

On a side note, it's important to me to be able to keep saving money. I set up an automatic withdrawal to send $25 each week to my eMM account. It's not much, but it's something and hopefully I can continue to add to the account and keep it going so that down the road I can have the down payment for a house or similar long term investment.

I'll work on the tally while I move, post that and also a snapshot of the current financial picture sometime soon...

Wednesday, December 29, 2004

Wednesday, December 22, 2004

Moving time

So next week I'll be moving into my new place. I have very little in the way of furniture, but I do have most of the other essentials. So this week I've been looking for a sofa, a chair, and a table and chair set. Discount furniture stores, classified ads, those have been my main source of looking for items. Nothing yet. A friend of mine keeps suggesting IKEA to me. She is very enthusiastic about what they have and their prices and quality. I don't know too much about their stuff, as there are no stores here. Their stuff can be shipped anywhere as apparently you have to put them together. I'm thinking about it. I don't want to go too cheap, but I want value.

I did buy a computer yesterday. The computer I have here at home is a four year old 600MHz eMachines. I was alerted that Staples has a special on Compaq Desktops, that have one that is $249.99 with a $50 rebate. It's a 2800MHz AMD Processor, with a 40GB harddrive, 256 RAM, CDRW drive, USB 2.0, Firewire, On board Ethernet, Sound and card reader, running on XP Home. A good deal, and something I would've needed sometime in the next year. That's the advantage of having some cash available, you can purchase things when you see an outstanding deal.

I did buy a computer yesterday. The computer I have here at home is a four year old 600MHz eMachines. I was alerted that Staples has a special on Compaq Desktops, that have one that is $249.99 with a $50 rebate. It's a 2800MHz AMD Processor, with a 40GB harddrive, 256 RAM, CDRW drive, USB 2.0, Firewire, On board Ethernet, Sound and card reader, running on XP Home. A good deal, and something I would've needed sometime in the next year. That's the advantage of having some cash available, you can purchase things when you see an outstanding deal.

Friday, December 17, 2004

Budgeting Smart

OK...so I signed the lease today.

Now I need to figure a system to best use my money. I get paid weekly,(and weakly)and I've got to figure out the best way to budget the money from week to week so that I have the amount to pay the rent and also that car payment

Does anyone have an easy system for something like this. Breaking down each week's pay and where it goes, how much can be used that week, and how much needs to be saved towards the bigger bills? Ideally, I also need to be able to put something towards savings as well. Is it even worth it to move your money around so that some is in a higher interest account for short periods? As short as a couple weeks?

In the past, I never put too much thought into this, and it cost me dearly. I was paying bank fees all over the place, because my checking account had a $150 "overdraft" protection, but each time you dipped into that, there was a $6.00 fee. I believe I personally paid for the holiday party at the bank one year. I haven't done this in over a year and half, and don't intend to start now, but want to be smart with my budgeting and finances.

Now I need to figure a system to best use my money. I get paid weekly,(and weakly)and I've got to figure out the best way to budget the money from week to week so that I have the amount to pay the rent and also that car payment

Does anyone have an easy system for something like this. Breaking down each week's pay and where it goes, how much can be used that week, and how much needs to be saved towards the bigger bills? Ideally, I also need to be able to put something towards savings as well. Is it even worth it to move your money around so that some is in a higher interest account for short periods? As short as a couple weeks?

In the past, I never put too much thought into this, and it cost me dearly. I was paying bank fees all over the place, because my checking account had a $150 "overdraft" protection, but each time you dipped into that, there was a $6.00 fee. I believe I personally paid for the holiday party at the bank one year. I haven't done this in over a year and half, and don't intend to start now, but want to be smart with my budgeting and finances.

Wednesday, December 15, 2004

Signing on the line...

So on Friday I will be signing the lease for the apartment. I was actually a little worried that my past credit history was going to come to haunt me even here. Apparently it didn't. They did a credit check, and my hard work of the past year and a half seem to have paid dividends in this case. But now I will have to pay $925 each month for a relatively small apartment, instead of using that money for paying debt and savings. I will say however, that I feel good that I have been able to put some away for an emergency fund and get some things started.

My immediate short term goals will be to learn frugally, and put any extra money I have at the end of the month towards my financial future. I am also exploring ways to make some money on the side, without having much overhead or having to work another job outside the house. One of the comments left on my previous post, suggested an eBook...1000 ways to make money. I spent the $19.90 to download it, and it's pretty interesting thus far...good suggestion. Keep them coming.

I'll try to get you the particulars of my purchases needed to move in, and what my budget is going to look like going forward as the details become known to me.

My immediate short term goals will be to learn frugally, and put any extra money I have at the end of the month towards my financial future. I am also exploring ways to make some money on the side, without having much overhead or having to work another job outside the house. One of the comments left on my previous post, suggested an eBook...1000 ways to make money. I spent the $19.90 to download it, and it's pretty interesting thus far...good suggestion. Keep them coming.

I'll try to get you the particulars of my purchases needed to move in, and what my budget is going to look like going forward as the details become known to me.

Monday, December 13, 2004

Moving on...

It sure looks like my savings plans might slow down considerably starting in January unless I can come up with another source of income. For the last year, I've had a living arrangement in which I have not had to pay rent. This will change as I plan to move at the end of the month. The money with which I had been making additional car payments and putting into my eMM account will now be used for rent.

Why rent? Property prices are out of this world in my area. Also, my credit is still shaky, I need another year or two to get back and stabilized. It's been nearly perfect for a year and half, but I need more time to keep building it.

Some of my decisions are being made right now for lifestyle. I want to live in a certain area, near my family friends. It will be a little less than an hour commute to my job, so my fuel and vehicle maintence costs are going to be pretty high. I'd like to make some additional income without leaving my house. I have another web venture which brings me maybe $150 - $200 on a monthly basis, and perhaps another $6000 in two other months. The next one of those months isn't until May, and will likely only be about $1500. So a more consistant monthly income would be welcome.

Why rent? Property prices are out of this world in my area. Also, my credit is still shaky, I need another year or two to get back and stabilized. It's been nearly perfect for a year and half, but I need more time to keep building it.

Some of my decisions are being made right now for lifestyle. I want to live in a certain area, near my family friends. It will be a little less than an hour commute to my job, so my fuel and vehicle maintence costs are going to be pretty high. I'd like to make some additional income without leaving my house. I have another web venture which brings me maybe $150 - $200 on a monthly basis, and perhaps another $6000 in two other months. The next one of those months isn't until May, and will likely only be about $1500. So a more consistant monthly income would be welcome.

Wednesday, December 08, 2004

Whoops...

So yeah...it's been awhile, huh? I didn't mean to take the whole month of November off from posting, but it happened. Here's the financial snapshot as of now to try to catch you up to date:

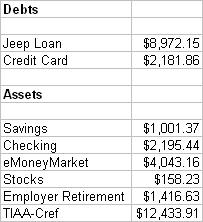

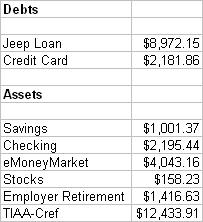

December Financial Snapshot

As you see there was some progress made in the month of November, though not as much as I had hoped. I had wished to pay off the credit card by now. A trip to California, and some work on my car effectively nixed that idea. Now, the money I have in my checking account is likely going to be needed to be used for rent and a security deposit starting January 1st. Going to be tough after that point to keep up the savings rate that I've started. I was supposed to be getting another $2000 from a web project, but that appears to have fallen through for the moment, though it could be revived anyday.

You see a new entry above. Knowing nothing about the stock market really, I decided to take my first baby steps in that area. I opened an account with Sharebuilder.com and put $200.00 into it. I bought $150 worth of Sirius (SIRI) and $50 of the Nasdaq 100. (QQQQ) Normally you would do the opposite, I know that much, putting the majority of your money into an Index type fund. Since it's a small amount, I reversed the roles. This is not serious investing, as I'm just trying to get some experience and work with this arena without getting burned too badly. As you can see, after the fees for purchasing the stocks and a couple days of losses on Sirius, I'm well down in my investment. I don't plan on checking it every single day, but I hope to keep adding to the Nasdaq investment slowly.

I'm not sure yet, but my overall goals may be shifting as well. I'm not sure if the part time by June idea is going to fly, but at the very least I do want to be debt-free by then and have more freedom to do whatever it is I want at that time.

Thanks to those of you who have inquired about the site, and if I'll be keeping it current. I do plan to do better. Keep coming back...

December Financial Snapshot

As you see there was some progress made in the month of November, though not as much as I had hoped. I had wished to pay off the credit card by now. A trip to California, and some work on my car effectively nixed that idea. Now, the money I have in my checking account is likely going to be needed to be used for rent and a security deposit starting January 1st. Going to be tough after that point to keep up the savings rate that I've started. I was supposed to be getting another $2000 from a web project, but that appears to have fallen through for the moment, though it could be revived anyday.

You see a new entry above. Knowing nothing about the stock market really, I decided to take my first baby steps in that area. I opened an account with Sharebuilder.com and put $200.00 into it. I bought $150 worth of Sirius (SIRI) and $50 of the Nasdaq 100. (QQQQ) Normally you would do the opposite, I know that much, putting the majority of your money into an Index type fund. Since it's a small amount, I reversed the roles. This is not serious investing, as I'm just trying to get some experience and work with this arena without getting burned too badly. As you can see, after the fees for purchasing the stocks and a couple days of losses on Sirius, I'm well down in my investment. I don't plan on checking it every single day, but I hope to keep adding to the Nasdaq investment slowly.

I'm not sure yet, but my overall goals may be shifting as well. I'm not sure if the part time by June idea is going to fly, but at the very least I do want to be debt-free by then and have more freedom to do whatever it is I want at that time.

Thanks to those of you who have inquired about the site, and if I'll be keeping it current. I do plan to do better. Keep coming back...

Friday, November 05, 2004

Saturday, October 23, 2004

Leaving on a Jet Plane

Endsleigh offer a wide range of Insurance Policies, including Car Insurance

---------------------------

I was only able to pay $100 towards my Credit Card this week. (The minimum payment was $59) I ended up making plans to visit a friend out in California the first week in December, and the price of the round trip airfare ended up being $250. Not bad, I think. I shopped around, both travel websites and Airline websites, and that was the best fare I came up with. It's through SouthWest, which seems to have many great deals if you can take advantage of them.

The next couple weeks will be saving for another monster $1000 car payment, I hope.

---------------------------

I was only able to pay $100 towards my Credit Card this week. (The minimum payment was $59) I ended up making plans to visit a friend out in California the first week in December, and the price of the round trip airfare ended up being $250. Not bad, I think. I shopped around, both travel websites and Airline websites, and that was the best fare I came up with. It's through SouthWest, which seems to have many great deals if you can take advantage of them.

The next couple weeks will be saving for another monster $1000 car payment, I hope.

Saturday, October 16, 2004

Weekly update

So what have done this week? The paycheck came in, and I moved $150 to the savings. I have a little bit of shopping to do today, but hopefully I can limit the damage somewhat. My car insurance payment came out this week. Next week I'll be making my credit card payment, and I'm hoping to make it as big as possible. $400 seems to be the biggest I'll be able to swing, but we'll see how it goes.

I got some figures for the extra income that I'll be getting at the end of this month. One source will net me $164.77 and the other $134.73. A total of $302.50. Not huge money, but it will eventually end up in the Virtual Bank eMoney Market account. That means the rest of my regular income can be used towards the Credit Card and Jeep payments.

The extra income comes mostly from another Web project I have going on.

I got some figures for the extra income that I'll be getting at the end of this month. One source will net me $164.77 and the other $134.73. A total of $302.50. Not huge money, but it will eventually end up in the Virtual Bank eMoney Market account. That means the rest of my regular income can be used towards the Credit Card and Jeep payments.

The extra income comes mostly from another Web project I have going on.

Saturday, October 09, 2004

The right strategy...

My Jeep payment of $1008 cleared earlier this week, and I did get my $100 check in the mail, so I'm laying low for the weekend, trying not to spend too much. I did shell out $30 for a bottle of Scotch for a friend of mine. I think I'll be able to make it to Wednesday without dipping into the savings at all. Check that, I had already transferred $50 over in the middle of the week. I'll return that next Wednesday when I put at least $150 back in the savings.

I've started getting comments on my postings here, all of which are interesting and much appreciated. I'm new to the financial world, having spent many years mis-managing money, so I'm just starting to get into good habits here. In the comments, I've gotten two very different bits of financial advice. One person said:

That person also stated that I should be taking the money I have in savings and Money Market to pay off the credit card and also put as much of it towards my Jeep.

I guess what I'm doing is trying to strike a balance. I need to have cash in savings in case of emergency...don't a lot of "experts" tell us that we need to have an emergency fund? I may also be invited to take part in some schooling, which would take 2 months, and during that time I would still need to pay my bills. In addition, after the first of the year, it's not going to be as easy to save money as it is now. I will be paying rent, utilities and all those things which my current situation allows me to avoid. I want to have some savings already, knowing that my ability to pay ahead and create savings is likely going to do down in 2005.

I'm interested in hearing what people have to say.

I've started getting comments on my postings here, all of which are interesting and much appreciated. I'm new to the financial world, having spent many years mis-managing money, so I'm just starting to get into good habits here. In the comments, I've gotten two very different bits of financial advice. One person said:

That's an interesting theory. I hadn't really heard it before, most of the advice you hear from everyone is to pay off those credit cards and other debts as soon as possible. Two other people checked in with comments and basically rebutted the above argument, one person saying:Better, I think to pay the minimum and save as much as possible. Cash is king not available credit. Factor the minimum on your bills as a fixed recurring expense in your budget then forget it. Do not fixate on the interest charges. Instead focus on the positive: the growing balance in your savings account!

If your interest rates are what I expect, you should immediately use up as much of your assets as would leave you with the least amount you can get by with, putting them towards your debts, highest interest rate first

That person also stated that I should be taking the money I have in savings and Money Market to pay off the credit card and also put as much of it towards my Jeep.

I guess what I'm doing is trying to strike a balance. I need to have cash in savings in case of emergency...don't a lot of "experts" tell us that we need to have an emergency fund? I may also be invited to take part in some schooling, which would take 2 months, and during that time I would still need to pay my bills. In addition, after the first of the year, it's not going to be as easy to save money as it is now. I will be paying rent, utilities and all those things which my current situation allows me to avoid. I want to have some savings already, knowing that my ability to pay ahead and create savings is likely going to do down in 2005.

I'm interested in hearing what people have to say.

Saturday, October 02, 2004

The Hunt for (in the) Black October

Time for the monthly preview of what I hope to accomplish this month financially.

Here's where I stand at the beginning of the month.

On Monday, I'm mailing out a payment of $1008.85 to Arcadia Financial (What does that tell you about my credit history?) for my Jeep Cherokee payment. That should amount to over $800 being put towards the loan principal. That should bring my balance to down around $11, 650. I'm told I'm getting mailed a $100 check on Monday, I'm not counting on it, but if I have it by the end of the week, that will help me out some.

That's going to leave me with very little money available until 10/13. That week, I will be putting $100 into my Credit Union savings. My car insurance payment and cell phone (which is my only phone) total about another $100.00. If I have to dip into savings the week before, I will replace it here, rather than putting more on the credit card. I hope to leave about $200 in the checking account by the time the next week comes along.

The week of 10/20 I'll be making a credit card payment. I would like to make another $400 payment, or even $500. We'll see what happens. Another $100 into the savings will be used as well, so I will use as much as I can towards those priorities and still having enough for food and gasoline.

The week of 10/27, I'm going to try to follow the pattern of September, and save as much as I can towards making another $1000 payment to my car due on 11/6. I get paid on 11/3, so it seems like this might be possible once again. Looking ahead, I'm expecting a large payment in November with which I hope to make a huge dent in the car payment for December. (like possible cut the remaining balance in half.)

I ask the readers...if there are any...if I were to get say $5000 in November, is putting it towards that high interest car loan the wisest place for it? Or would there be a more worthwhile place for it? Keep in mind, my goals here are to be living a very simple lifestyle on a part time income by the middle of next year. Having no car payment and no credit card debt makes that much easier to achieve.

I appreciate the mention from the PFBlog website last week, which was really the inspiration for this somewhat shameless knockoff of the same concept...thanks.

Here's where I stand at the beginning of the month.

On Monday, I'm mailing out a payment of $1008.85 to Arcadia Financial (What does that tell you about my credit history?) for my Jeep Cherokee payment. That should amount to over $800 being put towards the loan principal. That should bring my balance to down around $11, 650. I'm told I'm getting mailed a $100 check on Monday, I'm not counting on it, but if I have it by the end of the week, that will help me out some.

That's going to leave me with very little money available until 10/13. That week, I will be putting $100 into my Credit Union savings. My car insurance payment and cell phone (which is my only phone) total about another $100.00. If I have to dip into savings the week before, I will replace it here, rather than putting more on the credit card. I hope to leave about $200 in the checking account by the time the next week comes along.

The week of 10/20 I'll be making a credit card payment. I would like to make another $400 payment, or even $500. We'll see what happens. Another $100 into the savings will be used as well, so I will use as much as I can towards those priorities and still having enough for food and gasoline.

The week of 10/27, I'm going to try to follow the pattern of September, and save as much as I can towards making another $1000 payment to my car due on 11/6. I get paid on 11/3, so it seems like this might be possible once again. Looking ahead, I'm expecting a large payment in November with which I hope to make a huge dent in the car payment for December. (like possible cut the remaining balance in half.)

I ask the readers...if there are any...if I were to get say $5000 in November, is putting it towards that high interest car loan the wisest place for it? Or would there be a more worthwhile place for it? Keep in mind, my goals here are to be living a very simple lifestyle on a part time income by the middle of next year. Having no car payment and no credit card debt makes that much easier to achieve.

I appreciate the mention from the PFBlog website last week, which was really the inspiration for this somewhat shameless knockoff of the same concept...thanks.

Thursday, September 30, 2004

Small Victories

That's what this Blog is about. A lot of small steps towards getting myself where I want to be in the short term.

I'm still awaiting my $350 check...hopefully it'll be in today. I want to get the eMM stoked with another $500 deposit. Won't make it before the end of the month. Too bad. I've managed to be very frugal as planned the last couple weeks. If that continues through the weekend, I will be mailing that $1008 car payment on Monday. It will feel good, too.

I'm going to try to have a month end/month beginning summary/goals type post here in the next day or two. I'll chart my progress as well.

BSF

I'm still awaiting my $350 check...hopefully it'll be in today. I want to get the eMM stoked with another $500 deposit. Won't make it before the end of the month. Too bad. I've managed to be very frugal as planned the last couple weeks. If that continues through the weekend, I will be mailing that $1008 car payment on Monday. It will feel good, too.

I'm going to try to have a month end/month beginning summary/goals type post here in the next day or two. I'll chart my progress as well.

BSF

Wednesday, September 22, 2004

Making it through the month

I'm finding that this blog, though probably not heavily trafficked, is useful to me in jotting down what I do with my finances, but also in being able to look back at the beginning of the month and see what I wanted to do week-by-week and then follow through with it. From my check today, I put $100 in the savings, bringing me to $1200. Apparently I have about $346 in side income on it's way to me, so when I get that, it will be added to the $1200 and then $500 of that will be moved to the eMM account. Good shape there.

I also paid $400 towards my credit card instead of the $300 I had hoped for. This might leave me a little tight going into next week, as now I have just over $200 in my checking account and an almost empty gas tank on my Jeep Cherokee, so it's more like $170 in my account until next Wednesday.

The extra towards the credit card is somewhat negated because I had to use $90 of it last week because a unexpected bill could not be paid using my debit card. That was a little annoying, so I made up the extra in the payment for the month. For the moment, after the payment my balance will dip under $2000 for the first time since probably a month after I opened the account. (Yeah, I racked it up when I got it.) Interest charges will probably bump it up a little over the $2000 mark, but it will be nice to see it under while it lasts.

I want to be extremely frugal the next couple weeks as I'd really like to reel off a $1000 car payment on Oct 6th.

I also paid $400 towards my credit card instead of the $300 I had hoped for. This might leave me a little tight going into next week, as now I have just over $200 in my checking account and an almost empty gas tank on my Jeep Cherokee, so it's more like $170 in my account until next Wednesday.

The extra towards the credit card is somewhat negated because I had to use $90 of it last week because a unexpected bill could not be paid using my debit card. That was a little annoying, so I made up the extra in the payment for the month. For the moment, after the payment my balance will dip under $2000 for the first time since probably a month after I opened the account. (Yeah, I racked it up when I got it.) Interest charges will probably bump it up a little over the $2000 mark, but it will be nice to see it under while it lasts.

I want to be extremely frugal the next couple weeks as I'd really like to reel off a $1000 car payment on Oct 6th.

Thursday, September 16, 2004

9/16 update

From the pay this week, I moved $100 over to savings, making my balance there $1100. Ended up paying $148.38 for my phone...so both months are paid. $27.25 for car insurance.

Wednesday, September 08, 2004

Transactions

Initiated the transfer of $500 to VirtualBank today. My spending earlier in the week is going to leave me a bit tight for the week. I'm going camping this weekend, so my expenses shouldn't be all that much, but for gas and groceries, I'm going to have $97 available to get me through until this time next week. That includes paying my $75 phone bill. I just may wait a week on that and pay it next week.

So sometime in the next three business days my eMM account should be up to $3025. It's one thing accomplished this week.

So sometime in the next three business days my eMM account should be up to $3025. It's one thing accomplished this week.

Tuesday, September 07, 2004

Spending Spree

I may have put myself back a little bit with a trip to WalMart yesterday. I'm going camping this coming weekend, and needed a few things that I currently do not own. I got a sleeping bag, inflatable mattress, camp chair and a few other things. Damage came to $171. Not too bad, actually, as this will probably be stuff I'll have for years. I needed an Air Mattress anyway, as when I go looking for new housing for January, I may not have a bed to move in with. I also purchased my groceries for the week in the same trip.

I mailed the $608.85 for the car and $370 for the charity. I'm still hoping to be able to put the $200 into my savings so I can then transfer $500 to VirtualBank later this week.

In some good news, my car insurance dropped from $102 monthly all the way down to about $25. This is because my ex-wife is no longer on the policy. It took them a number of months to take her off the policy. I suspect the rate will go back up a little bit at renewal time, but the savings in the short term is good. If I'm smart, I'll take that "found" $75 and put it towards savings or the bills.

I should have an update either tomorrow or the next day on what I end up doing with the finances this week.

I mailed the $608.85 for the car and $370 for the charity. I'm still hoping to be able to put the $200 into my savings so I can then transfer $500 to VirtualBank later this week.

In some good news, my car insurance dropped from $102 monthly all the way down to about $25. This is because my ex-wife is no longer on the policy. It took them a number of months to take her off the policy. I suspect the rate will go back up a little bit at renewal time, but the savings in the short term is good. If I'm smart, I'll take that "found" $75 and put it towards savings or the bills.

I should have an update either tomorrow or the next day on what I end up doing with the finances this week.

Wednesday, September 01, 2004

Goals for September

Let's try to see what I want to accomplish this month.

Today I sent a payment of $608.84 for my car payment. The amount due each month is $408.85. I have to send off another check for $370 in the next couple days for some charity I commited to. That will pretty much clear out the checking account.

I have $1300 in the brick & mortar savings and may have to use a little of that to get by until next week, though I hope not. I'm expecting a check in the mail for $100 in the next day, so that should help. I want to always have $1000 in this account, and each time I get to $1500...I'm putting $500 into the higher yield eMoneyMarket account at VirtualBank (2.15% APY) They have a promotion going that would give you and I $20 each if you open an account with them. ($100 min) If you're interested in making us both $20 and getting a great rate, email me at the above address and I'll get you a referral.

Next week's check (the 8th) of $592...I'll need to pay my cell phone, which is about $75. I want to hopefully I'll have enough to put into my saving to bring to $1500, triggering the move to the eMoneyMarket. I'll need about $150-$200 for gas and groceries.

The following week (the 15th) I'll want to stash $100 into the savings. Then try to leave the rest in the checking. Again, probably will need $150 to $200 for expenses. Hopefully that will leave at least $200 in the checking and $1100 in savings.

The next week (the 22nd) Another $100 to savings, bringing that to $1200. Another $150-$200 for expenses and the aproximate balance in the checking should be around $400. I'll need to make a payment on my credit card at this time. Hopefully $300. That brings me down to about $100.

The last week (the 29th) Other than the usual expenses, I plan to leave as much in the checking as possible, to couple with the next week and make as big a car payment as I can the first week of October. Hopefully $1008.85. That same week I'm expecting a $350 check in the mail. I plan to put that into savings and make another move to the eMM account.

So at the end of the month, I hope to have done the following:

Paid the Car $608.85

Paid the phone $75.00

Paid the Credit Card $300.00

Keep my savings balance of at least $1000.00

Have a balance in the eMM of $3525.00 plus interest.

Have a good amount towards a $1008.85 payment on the car for October 6.

My Credit Card balance should be around $1950.00

My Car loan balance should be around $11,700 after the October 6th payment.

Today I sent a payment of $608.84 for my car payment. The amount due each month is $408.85. I have to send off another check for $370 in the next couple days for some charity I commited to. That will pretty much clear out the checking account.

I have $1300 in the brick & mortar savings and may have to use a little of that to get by until next week, though I hope not. I'm expecting a check in the mail for $100 in the next day, so that should help. I want to always have $1000 in this account, and each time I get to $1500...I'm putting $500 into the higher yield eMoneyMarket account at VirtualBank (2.15% APY) They have a promotion going that would give you and I $20 each if you open an account with them. ($100 min) If you're interested in making us both $20 and getting a great rate, email me at the above address and I'll get you a referral.

Next week's check (the 8th) of $592...I'll need to pay my cell phone, which is about $75. I want to hopefully I'll have enough to put into my saving to bring to $1500, triggering the move to the eMoneyMarket. I'll need about $150-$200 for gas and groceries.

The following week (the 15th) I'll want to stash $100 into the savings. Then try to leave the rest in the checking. Again, probably will need $150 to $200 for expenses. Hopefully that will leave at least $200 in the checking and $1100 in savings.

The next week (the 22nd) Another $100 to savings, bringing that to $1200. Another $150-$200 for expenses and the aproximate balance in the checking should be around $400. I'll need to make a payment on my credit card at this time. Hopefully $300. That brings me down to about $100.

The last week (the 29th) Other than the usual expenses, I plan to leave as much in the checking as possible, to couple with the next week and make as big a car payment as I can the first week of October. Hopefully $1008.85. That same week I'm expecting a $350 check in the mail. I plan to put that into savings and make another move to the eMM account.

So at the end of the month, I hope to have done the following:

Paid the Car $608.85

Paid the phone $75.00

Paid the Credit Card $300.00

Keep my savings balance of at least $1000.00

Have a balance in the eMM of $3525.00 plus interest.

Have a good amount towards a $1008.85 payment on the car for October 6.

My Credit Card balance should be around $1950.00

My Car loan balance should be around $11,700 after the October 6th payment.

Tuesday, August 31, 2004

The Situation

Some details:

$592 in weekly take home salary.

About $200 to $250 a month in other income

Expecting about $5000 lump sum in November

Possibly another $2500 in lump sum as well, around the same time.

Current Savings:

eMoneyMarket account: $2500

Standard Savings: $1300

(I'm keeping my retirement accounts out of the equation at the moment.)

Debts:

Car payment: $408 a month,(Minimum) amount remaining on loan: $12,500

Credit Card: Balance of $2250

Those are the two things I hope to have paid off by June 2005.

Monthly expenses:

Rent: None for the rest of the year...good deal.

Gasoline: about $300/month

Cell Phone: $75/month

Food/Recreation $600/month (budgeted)

Car Insurance: $102/month

Utilities: N/A

So really, I have less than $1100.00 in monthly expenses outside of my Car and CC.

What I plan to document here is where money is going each week, what I do with "extra" money and how the plan is shaping up. I'll also try to post any tips I get for generating a little extra income and how to make the most of the money that I have.

Again, the goals:

$6000 in savings by the end of 2004.

Pay off the Credit Card by the end of 2004

Pay off the Car by June, 2005.

Wish me luck.

BSF

$592 in weekly take home salary.

About $200 to $250 a month in other income

Expecting about $5000 lump sum in November

Possibly another $2500 in lump sum as well, around the same time.

Current Savings:

eMoneyMarket account: $2500

Standard Savings: $1300

(I'm keeping my retirement accounts out of the equation at the moment.)

Debts:

Car payment: $408 a month,(Minimum) amount remaining on loan: $12,500

Credit Card: Balance of $2250

Those are the two things I hope to have paid off by June 2005.

Monthly expenses:

Rent: None for the rest of the year...good deal.

Gasoline: about $300/month

Cell Phone: $75/month

Food/Recreation $600/month (budgeted)

Car Insurance: $102/month

Utilities: N/A

So really, I have less than $1100.00 in monthly expenses outside of my Car and CC.

What I plan to document here is where money is going each week, what I do with "extra" money and how the plan is shaping up. I'll also try to post any tips I get for generating a little extra income and how to make the most of the money that I have.

Again, the goals:

$6000 in savings by the end of 2004.

Pay off the Credit Card by the end of 2004

Pay off the Car by June, 2005.

Wish me luck.

BSF

Monday, August 30, 2004

Where to begin

This Blog is meant to serve as a diary for my personal finance goals. In short, I hope by the middle of 2005 to be able to support myself on a part time income, and have as little debt and as much savings as possible.

To get there, I have some hurdles to overcome. Not as many as some people, but enough that this project is going to need some creativity and serious budgeting.

I'll lay out the details in coming days and how I hope to proceed. Advice and feedback is always welcome.

To get there, I have some hurdles to overcome. Not as many as some people, but enough that this project is going to need some creativity and serious budgeting.

I'll lay out the details in coming days and how I hope to proceed. Advice and feedback is always welcome.

Subscribe to:

Posts (Atom)